2016 Trading Results

from our Premium Service

- The Daily Report -

- Emini S&P500: +205 points

- Emini S&P500 mid-term strategy***: +130 points

- 30Y T-Bonds: +6.18 points (from February 2016)

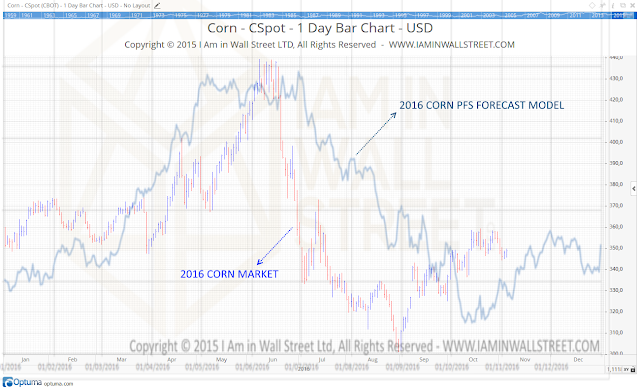

- Corn: +58 points per contract

- Soybeans: +260 points per contract

- Wheat: +40 points per contract (from February 2016)

- Gold: -72 points per contract

- Live Cattle: +8.21 points per contract (from June 2016)

***the mid-term strategy is a Daily trading strategy where I say when to buy or sell based only on the forecast.

In the last year we provided also a mid-term strategy for Soybeans, we made 7 trades all over the year, with 7 winners and 0 losers, and a profit of 232 points per contract (+11.600 USD each contract!!!), this is the evidence of how the forecast works well.

We are in profit with every Market we trade since 2012, with all the trades documented, (except for Gold, where we had a very tough 2016 due to missed trends that started always in overnight).

We are traders first of all, and we want to look at numbers; this is the chart of our strategy performance since 2012 of the S&P500:

Hurry up! the Daily Report Service will not be available forever, a big change is about to come in the next months, and it will turn to a service for professionals to a price that will be 5 times higher than now. The reason is simple: it works and it is worth to spend even 20.000 USD per year if you can trade millions! The project for the future is to provide a Live line in streaming where to see the trades and the positions of my strategy in real-time. We will also provide tailored studies. If you do not take advantage of it now, you will regret it later, because if you subscribe it now, you will keep the same price for the next years.

More details in the next months...

And next week a new Market Forecast will be ready: Cotton!

You can find our services here: Service page:

Daily Report Service - The premium service

Weekly Report Service - Reports and studies every week.

2017 S&P500 Forecast Bulletin

2017 Corn and Soybeans Forecast Bulletin

2017 Live Cattle Forecast

You can read the previous Newsletters following this link:

http://archive.aweber.com/awlist3900413

Best Regards,

Daniele Prandelli

I Am in Wall Street Ltd

LinkedIn: https://www.linkedin.com/in/daniele-prandelli-3aab15112

e-mail: info@iaminwallstreet.com

Skype: I Am in Wall Street

http://www.iaminwallstreet.com

High Probaility Trading Techniques - S&P500, 30 Year Treasury Futures Bonds, Crude Oil, Gold, Corn, Soybeans, Wheat, Forex, Stocks, Silver, Live Cattle and S&P/ASX200.